Illawarra, Shoalhaven & South Coast property specialists

Integrity Real Estate is a market leader in residential and commercial real estate on the South Coast.

With offices in Nowra and Wollongong, we work with clients from the Southern tips of Sydney and across the Illawarra, Shoalhaven, South Coast and Eurobodalla regions. In addition to real estate sales, leasing and property management, we provide comprehensive strata and community management services.

Residential

Find your perfect home

with Integrity.

Integrity Real Estate is a market leader in residential real estate sales and leasing on the South Coast

Our sales and property management team comprises real estate professionals with years of local experience and a well-earned reputation for great service, clear communication and premium results.

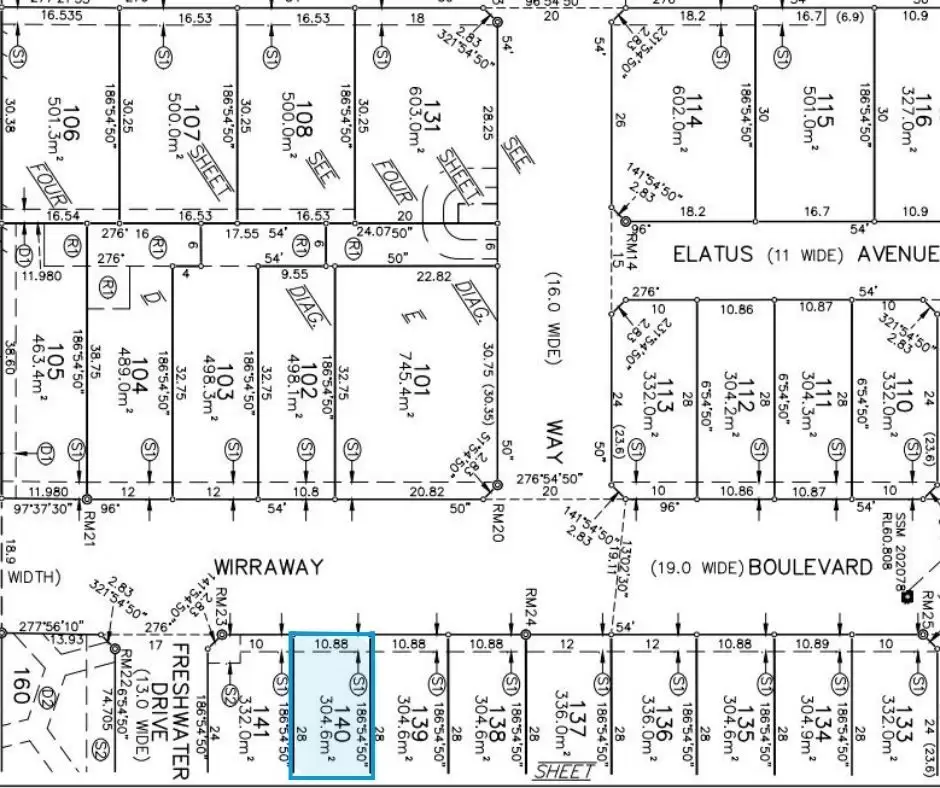

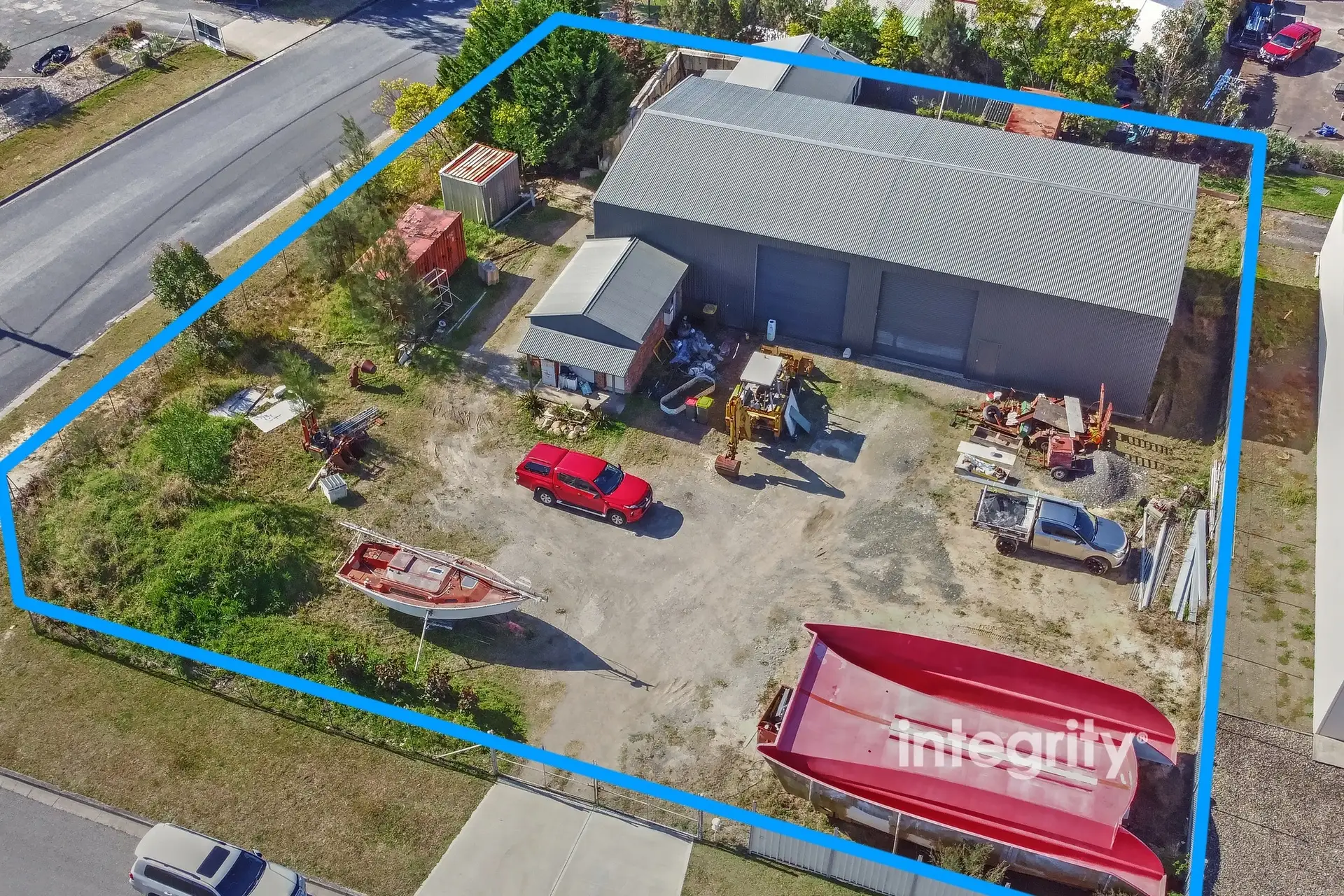

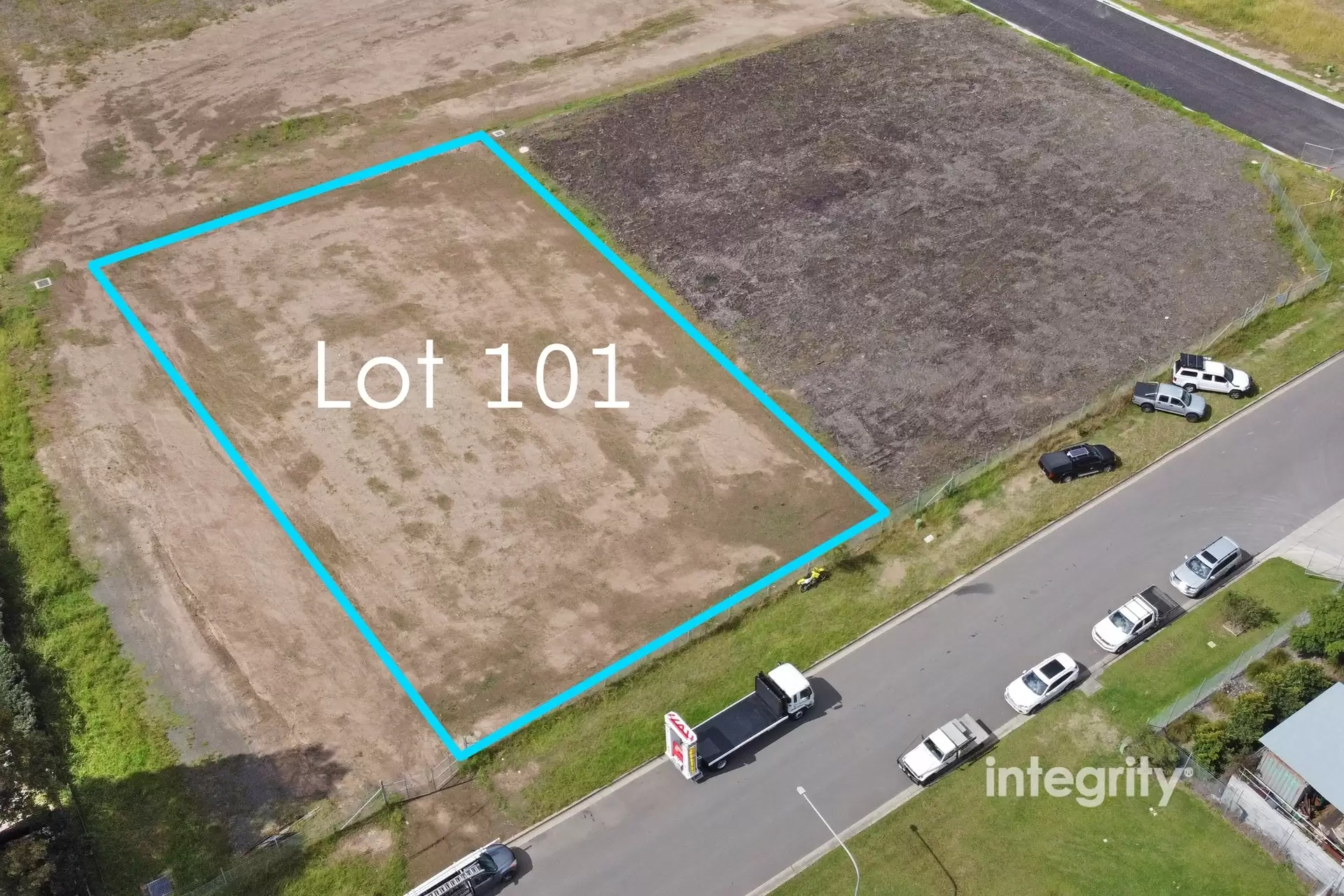

Commercial & Industrial

Position your business

with Integrity.

Integrity Real Estate offers a full suite of commercial and industrial real estate services - including sales, leasing and management.

Trust our experienced team to make your next commercial property transaction straightforward and stress-free.

Strata & Community Management

Complete strata management

with Integrity.

Since 2002, Integrity has offered strata services in the Illawarra, Shoalhaven, Southern Highlands and Eurobodalla.

Our expertise in strata management extends to all facets of strata, including residential, commercial, industrial and mixed use and community schemes. From taking over management of existing schemes or working with developers to set up a new strata scheme, Integrity can help.

Latest properties